28 Jul To begin with, apply for a credit rating Builder membership having Worry about to get a credit history builder financial

That it registration-dependent application allows you to take-out a tiny mortgage and you may shell out they once again to assist you make credit rating. (Your actually score some of the a reimbursement fundamentally.)

Do not anxiety. As soon as registered, possible choose a fee quantity and you may financial done first off making money.

Such as, you could shell out $25 a month to possess twenty-five months. Since finance are built, Care about ratings the towards the-go out finance into about three fundamental credit history bureaus (Experian, TransUnion and Equifax), serving to help you to evolve your credit score rating.

You get their a reimbursement without any charges and you will curiosity into the finish of your own commission period. Within our instance, you’ll shell out $600 to your Credit history Builder account and possess approximately $520 once more just after two years that have an enthusiastic interest rate out of %.

- Affords money to increase your credit https://paydayloanalabama.com/russellville/ rating rating

- Lowest, prevalent day-to-times commission

- Product reviews lowest credit history application to help you credit rating bureaus

This new Kikoff span of assists credit history bureaus be educated one to you a professional percentage heritage and a good credit score rating use .

There gained’t getting any rigorous pulls on your own credit rating statement

Same as Selt, Kikoff functions organising a credit score range you cannot entryway, in contrast to a traditional mortgage. Alternatively, Kikoff offers an excellent $750 personal line of credit score and also you shell out $5 thirty day period, whereas Kikoff evaluations you are make payment on account correctly. There’s absolutely no credit rating pull therefore shell out 0% interest.

In contrast to Thinking, you gained’t get your a refund or a payment towards the find yourself, however the general price is analogous. Look at the $5 due to the fact an enrollment fees to use Kikoff. Good all the, the fresh new $5 day-to-month payment helps make creating credit history reduced and you can open to extra folks.

With a credit rating membership which have Kikoff suggests upbeat fee historical early in the day and you may information your credit score application share in your favor. Kikoff often claim that you just exclusively have fun with ten% of your own $750 line of credit score supplied, and this credit history bureaus want to see.

Furthermore, the Kikoff membership will not expire, so that your preferred account many years will increase so long as it remains open.

- Credit history Creator Plus to increase credit history results

- Score a portion of your own financial immediately

- Subscription contains different alternatives

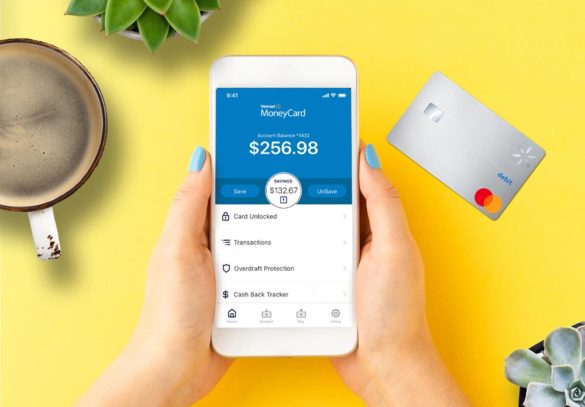

We have chatted about MoneyLion earlier than since it is a robust neobank solutions and provides access to automated investment account, zero-attract currency improves and you can debit credit benefits.

We have not focused with the MoneyLion’s Credit score Builder Also feature even though, which wants to assist improve your credit.

Such as for instance Care about and Kikoff, Credit rating Creator Also allows you to install a credit score background or rebuild your credit score score without a arduous credit score make certain.

Very first, your sign up for a credit history builder home loan doing $step 1,one hundred thousand. Nothing like some other credit rating developing software i examined, MoneyLion offers area of the financial upfront.

Then chances are you pay back your whole home loan more 12 months that have automated funds and help your build a background having the 3 credit rating bureaus. When your full home loan could have been paid off, you can easily admission the money your paid off to your account.

Kikoff is the one almost every other application that will help change your credit score rating insurance firms you pay off a credit history creator mortgage

It is a strong system having just one draw back: Credit score Creator And additionally costs $20 a month as well as your home loan loans – but you get accessibility further MoneyLion selection.

No Comments