02 Ago 2020 Help guide to California Education loan Forgiveness Programs

Ca try an extraordinary place to live, not only as it keeps tons of views observe, beaches to check out, and you can Disneyland to check out, plus since the condition also provides numerous powerful Government Student loan Forgiveness Software to help you people hidden for the college or university loan loans.

Anyone who lives in the brand new Wonderful State and you will who is having difficulties due to their funds is hear this, just like the California’s student loan forgiveness programs review between the best in the complete country, giving exceptional advantageous assets to those who be eligible for the fresh prize.

To get education loan forgiveness into the Ca, you will need to feedback the newest readily available forgiveness apps less than, paying close attention on their Eligibility Statutes, and you may App Tips to decide and this system work ideal for you.

Rating Assistance with Your Money!

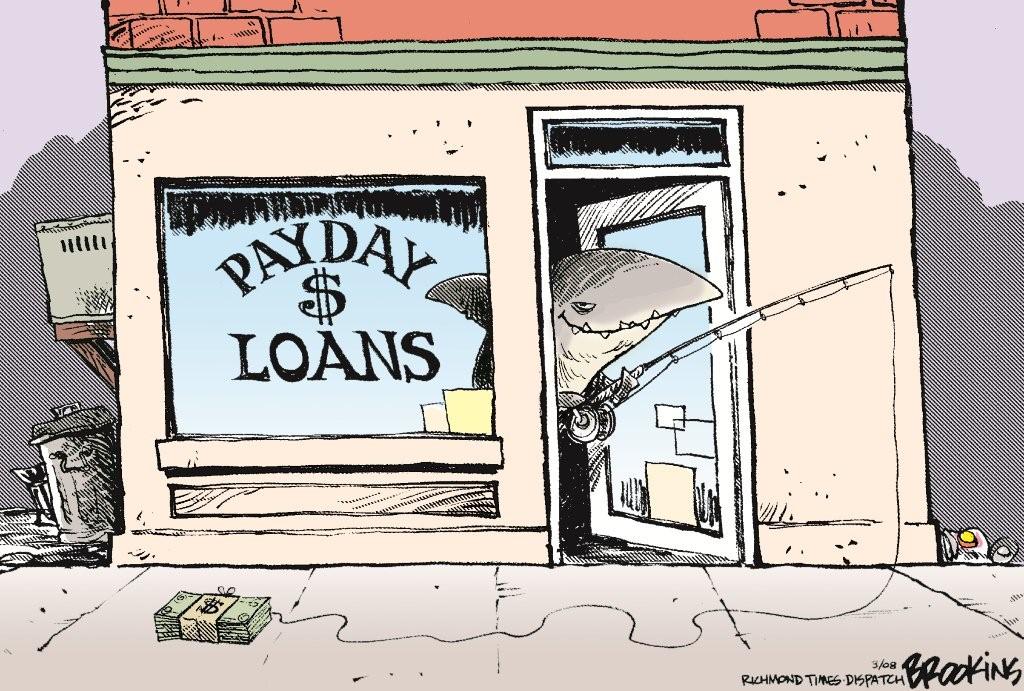

If you are it really is enduring education loan obligations, then you certainly should think about purchasing a student-based loan Debt relief Service to have assist. Why? Since someone functioning during the these firms deal with student loans all day long, day-after-day, and perhaps they are your absolute best options at determining getting your own loans back down.

Having assistance with Government College loans name the latest Education loan Recovery Helpline on 1-888-906-3065. Might feedback your circumstances, glance at the choices getting switching payment agreements, consolidating your own finance, otherwise seeking forgiveness pros, next establish you to get rid of the debt because quickly as possible.

For advice about Personal College loans phone call McCarthy Law PLC on 1-877-317-0455. McCarthy Laws usually discuss with your financial to settle individual finance having a lot less than your currently are obligated to pay (normally 40%), then get you a special mortgage towards lower, settled matter to help you repay the old financing, resolve their borrowing from the bank and reduce the monthly payments.

I have invested a decade choosing credit card debt relief businesses, talking to all types of «experts», and they will be simply one or two firms that We faith to help you assist my personal clients. When you have a bad experience with sometimes of those, excite make sure to come back and you can tell me throughout the they on the Statements!

The Steven Yards. Thompson Medical practitioner Corps Mortgage Percentage

The newest Steven M. Thompson Physician Corps Mortgage Fee system repays doing $105,000 inside the eligible student education loans reciprocally working as a health care professional within the a california HPSA.

- You truly must be an enthusiastic allopathic or osteopathic medical practitioner

- You really must be free of one contradictory contractual solution debt

- You really must have a good academic debt of a national otherwise commercial loan company

- You must have a legitimate, unrestricted permit to apply medicine when you look at the California

- You truly must be currently employed otherwise has actually acknowledged employment within the a beneficial Health professional Scarcity Elements (HPSA) in the California

- You must invest in bringing full-date direct patient proper care for the a HPSA to possess no less than three-years

The Ca Condition Loan Fees Program

The brand new California State Mortgage Cost Program offers up to $50,000 as a whole student loan forgiveness experts. This program authorizes costs out-of informative financing to help you health professionals whom commit to habit in the parts of the official which were deemed getting clinically underserved.

- You need to haave a recent open-ended California licenses.

- You should be an effective Us resident

New CDA Foundation Student loan Cost Grant

The brand new CDA Basis Education loan Cost Offer honors has to pick present dental college or university/expertise graduates. Such gives helps job solutions of the permitting recent graduates pay-off their finance, and offers as much as $35,000 in forgiveness masters a-year, having all in all, $150,100000 more than 3 years. Including the other companies in the list above, the fresh receiver must agree to bringing care and attention for the a clinically undeserved neighborhood. On top of that, whenever you are an offer athlete-right up, the new Webb Nearest and dearest Give usually award to $5,000 toward future education expenses.

Can i Owe Fees on my Forgiven Loans?

There was a distinct chance that you will owe taxation towards the the brand new forgiven personal debt, unless of course the student loan consists of that loan forgiveness supply based on services on your field of works.

According to the current Internal revenue service legislation, legislation states that one debt forgiveness acquired need certainly to count as nonexempt money, if you had $ten,100000 during the college loans forgiven, you’ll have to list you to $ten,one hundred thousand as income in your tax get back, and you may pay taxes against it. To have information about just how this performs, please visit my personal page towards Education emergency loan to pay payday loans loan Forgiveness and Taxable Earnings Statutes.

This will cause enormous harm to consumers who had been utilized to creating quick, monthly obligations up against the figuratively speaking, however, who is now able to are up against a huge, lump-sum payments considering the Internal revenue service.

I do believe its including an issue that We have depending a totally this new web site to assist individuals with taxation-related dilemmas, titled Skip Taxation Loans. On Forget Taxation Loans, I offer tax and taxes-associated pointers, same as I really do right here to have college loans.

In which Should i Pick Other Issues?

For questions about standard student loan save, whether you need assistance with Government otherwise Personal funds, make sure to check out the most other pages of my webpages, which cover the niche during the stressful outline.

When you yourself have almost every other questions regarding California student loan forgiveness pros, forgiveness, or cancellation apps, delight log off them on the comments section lower than and you may I’ll perform my personal far better answer her or him in 24 hours or less.

Disclaimer:Advice extracted from Ignore Student loan Financial obligation is actually for instructional purposes merely. You really need to request an authorized monetary elite prior to making people monetary conclusion. Your website gets certain compensation courtesy affiliate dating. This site is not endorsed or affiliated with brand new You.S. Company regarding Knowledge.

By: Tim Marshall

Tim’s experience experiencing smashing education loan debt contributed your to help you create the web site Forget about Student loan Loans in 2011, where the guy has the benefit of information, tricks and tips to own paying student loans as quickly and you can inexpensively that one may.

No Comments